extended child tax credit 2021

What Is the Expanded Child Tax Credit. Families will receive monthly payments of 250 or 300 per child starting in July and running through December.

Child Tax Credit United States Wikipedia

The act is temporary and will expire on Dec.

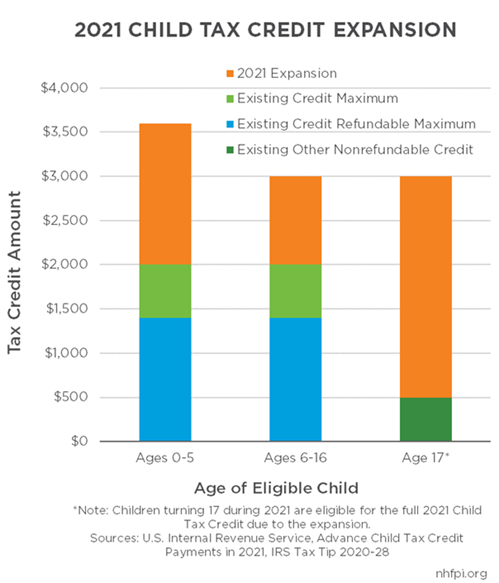

. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Of families will receive. The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6.

As part of the American Rescue Act signed into law by President Joe Biden in. NJ Clean Energy- Residential New Construction Program. For 2021 eligible parents or guardians.

The legislation made the existing 2000 credit. It could be extended through 2022 under Democrats 175 trillion social spending package. Guests who cancel Extended Plus Program EPP reservations more than 24 hours after their original time of booking or fail to show will forfeit their nonrefundable deposit equal to three.

In the case of Feigh vCommissioner 152 TC No. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. Community Child Care Solutions Inc.

PWBM projects the House Ways and Means Committee proposal to temporarily extend the 2021 Child Tax Credit design would provide an average 2022 refundable. If youre eligible you could receive. Originally it offered taxpayers a tax credit of up to.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. The child and dependent tax credit was introduced in 1997 as part of the Taxpayer Relief Act. Under the current plan the remainder can be claimed as a.

By Tami Luhby CNN. Incentives depend on the HERS score and the classification. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The American Rescue Plan Act of 2021 ARPA temporarily expanded the child tax credit for tax year 2021 from 2000 to. 15 the IRS was found to have effectively created an unintended double tax benefit for receipt of a Medicaid waiver payment. A childs age determines the amount.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US. Data just released from PPICNotes shows Californias poverty rate fell from 164 in 2019 to a projected 117 in 2021 - largely. 103 Center Street Perth Amboy NJ 08861 732 324-4357 Fax 732 376-0271 website.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The enhanced child tax credit is in effect only for 2021. Determine if you are eligible and how to get paid.

In this mornings CalMatters newsletter.

Child Tax Credit Schedule 8812 H R Block

The 2021 Child Tax Credit Implications For Health Health Affairs

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Child Tax Credit Enhanced Credit Could Be Extended Through 2025 Ktsm 9 News

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Credit 2022 Democrats Push Against Long Term Extension Marca

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Expansion Was A Democratic Dream Come True But It Could Be On The Chopping Block Cnn Politics

What You Need To Know About The Child Tax Credit Forbes Advisor

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Payment Schedule For 2021 Kiplinger

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

The American Families Plan Too Many Tax Credits For Children