home office art tax deduction

On April 4 2022 the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID generated by SAMgov. The article number or location in the tax treaty that contains the saving clause and its exceptions.

Small Business Tax Deductions 29 Popular Breaks In 2022 Shopify

The type and amount of income that qualifies for the exemption from tax.

.png)

. Article 20 of the US-China income tax treaty allows an. The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAMgov. Sufficient facts to justify the exemption from tax under the terms of the treaty article.

The unique entity identifier used in SAMgov has changed.

150 000 Of Art 100 Deductible The Small Business Tax Deduction Buying Collecting Art

Quiz Do I Qualify For The Home Office Deduction

Work From A Home Office Claim A Tax Deduction And Save Money Tax Deductions Saving Money Deduction

10 Creative But Legal Tax Deductions Howstuffworks

Irs Home Office Tax Deduction Rules Calculator Working From Home Home Business Home Office

Claiming Art As A Tax Deduction 2022 M Contemporary

Claiming Art As A Tax Deduction 2022 M Contemporary

Claiming Art As A Tax Deduction 2022 M Contemporary

Tax Preparation Cartoons And Comics Funny Pictures From Cartoonstock

Video Expenses That Are Tax Deductible When Working From Home Turbotax Tax Tips Videos

The Home Office Deduction Audit Risk Myth Keeper Tax

Why Every Side Hustler Needs A Home Office Lucrative Tax Deductions

An Ode To The Home Office The New Yorker

Claiming Art As A Tax Deduction 2022 M Contemporary

Tax Deductible Expenses For Interior Designers All Things Taj

.png)

Quiz Do I Qualify For The Home Office Deduction

Taxes 2022 How Small Businesses Can Deduct Home Office Expenses Gobankingrates

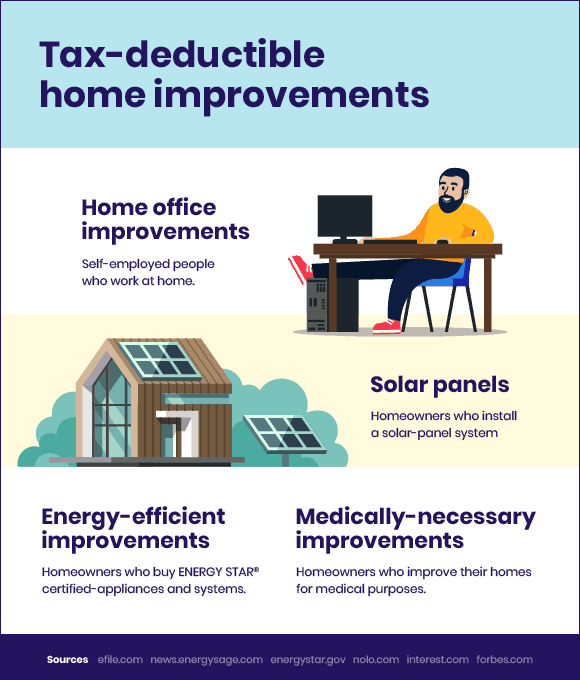

The Home Improvement Projects That Offer The Biggest Bang For Your Buck Taxact Blog

Are Your Home Improvements Tax Deductible Home Improvement Property Improvements Tax Deductions